November is more of a sprint than a marathon for many advertisers, and 2023 was a mad dash for retailers in their efforts to coax consumers to shop their brands till they drop.

Black Friday aside, the month marks another pivotal moment in our Streaming Recap series as we welcome Crackle to our squad of CTV staples. Let’s dive into the data.

Top platforms

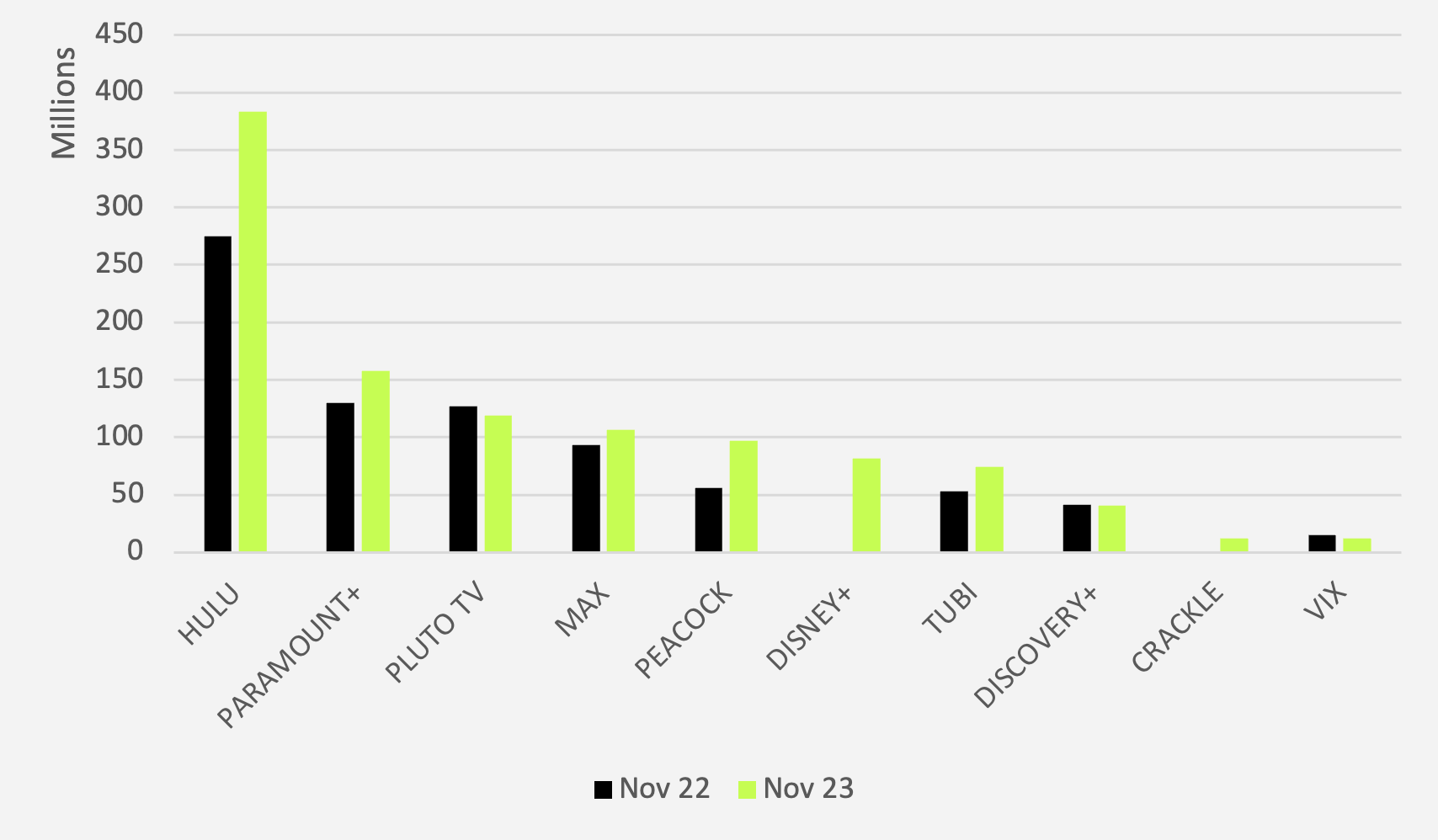

In November we saw $1.08B spent across this dynamic top 10, marking another record month for CTV. But our host of platforms is growing even more dynamic.

Adding Disney+ in March and now Crackle skews our year-over-year grand total comparison, but we will highlight that we saw spend decrease from November 2022 to November 2023 for Discovery+ by 3.3% and Pluto TV by 6.7%.

Most notably, Vix spend was down 20.6% between years, setting a record in its own right—for the greatest decrease in year-over-year investment in the platform in 2023.

November 2022-2023: Ad spend by platform YOY

Source: Vivvix

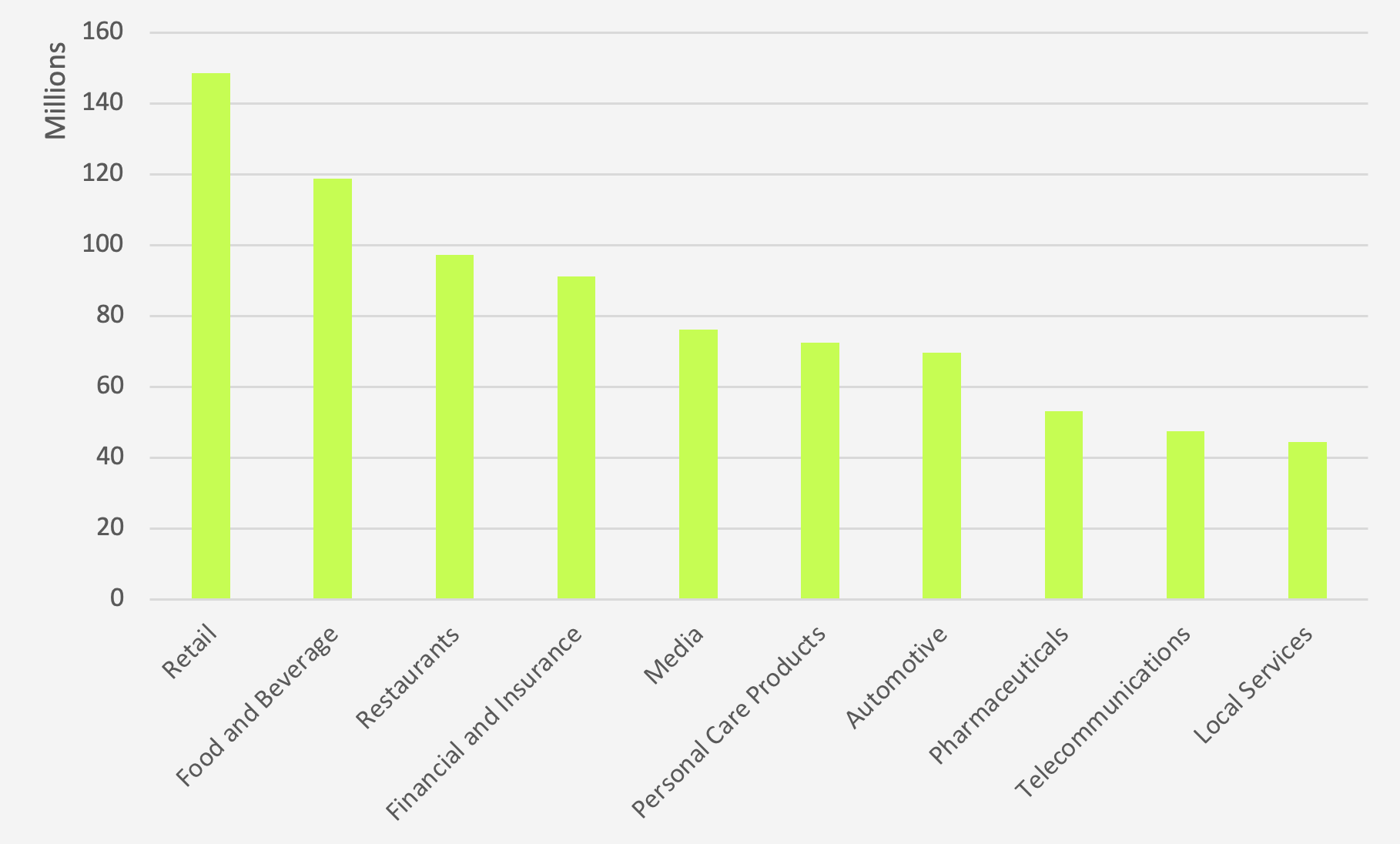

Leading industries

2. Food and beverage

3. Restaurants

Retail headed up the rankings for the top-spending industry in November with $148.4M after showing up in the fourth slot in October. There was a 60% jump between months—shaking out to about $56M—a massive rebound. Hulu and Pluto TV were the preferred platforms within the industry with dedications of $40M and $42.6M, respectively.

Financial and insurance spend rose by one rank, boosting the industry into the fourth slot with $91M total—$15.4M more than October. The industry remained the top Tubi investor with $19.6M toward the platform or 21.5% of total spend by those advertisers.

Personal care products also moved up one rank with $72.5M total—an additional 27% investment of $15.3M. About 9.5M of those extra dollars went toward Hulu to up the ante on the industry’s investment in the platform month-over-month.

As for the stats on Crackle, media advertisers allocated the greatest chunk of their CTV budgets to the platform across our top 10 with $3.26M, followed by restaurants with $2.2M.

- Retail topped the charts with $148.4M, marking a 60% increase from October

- The financial and insurance industry secured the fourth slot with $91M at a $15.4M increase from October

- Crackle attracted the most dollars from media of any industry, receiving $3.26M, followed by $2.2M from restaurants

November 2023: Industry rankings

Source: Vivvix

Top spenders

2. Apple

3. Pfizer

Amazon slid into first again as they did in July, investing 41% more this time around (and 303% more than they did in May). As for the contrast between their November and October numbers, they opted to spend 49% more on CTV overall in November, leaning more on Pluto TV than before with an additional $10K allocation.

Apple spend was also on the ascent as the tech giant spent 78% more on CTV month-over-month, still dodging Disney+ but placing more emphasis on Hulu. The platform received 56% of their overall CTV contribution in terms of our top 10.

Source: Vivvix

Source: Vivvix

Absent from our top 20 in October, Pfizer was our leading Crackle investor, spending 20% of their top-10 funds there. Paramount+ was their first choice with a marginally higher share of 23%.

Chewy.com made their premiere in our top 10, claiming the fourth slot. They spent no dollars on Disney+ despite the pets industry’s burgeoning spend on the platform, focusing their efforts on Pluto TV instead.

- Amazon led, increasing their CTV investment by 49% over October

- Apple spend was up 78% month-over-month and they favored Hulu

- Pfizer emerged as the number one Crackle investor, spending 20% of their top-10 funds on the platform

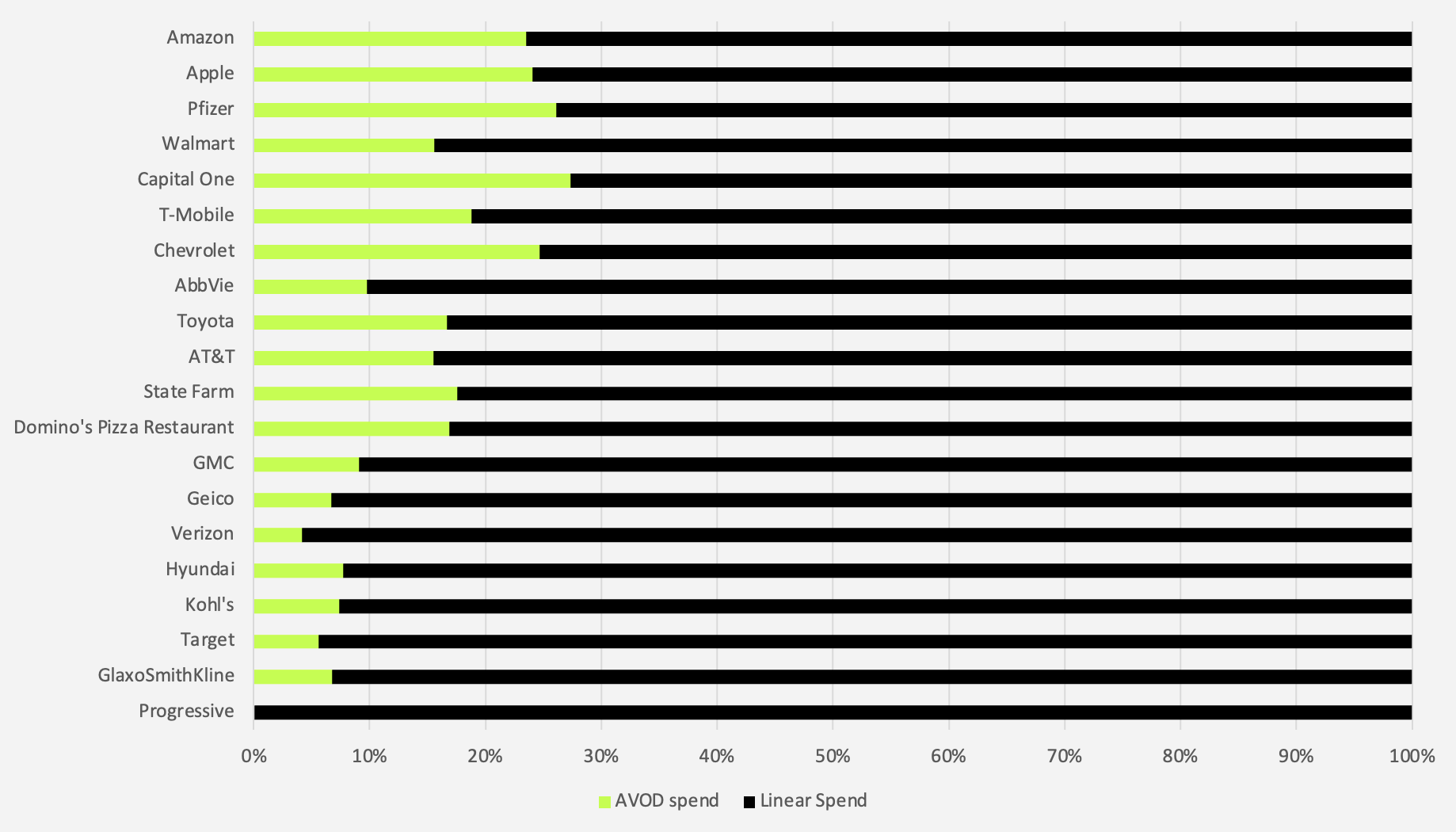

Streaming vs. linear

Amazon also led up our combined AVOD/linear top 20 rankings, spending the most on AVOD of any brand. However, they did not come in first for the highest percentage of total spend devoted to our top 10 streaming platforms with 23.5%.

Capital One held that title, giving 27%, followed by Pfizer with 26%, then Chevrolet with 25%.

We’ve long been monitoring Progressive, and we saw them revert to negligible AVOD spend. That investment has decreased since its peak in August and reached a nadir in November.

November 2023: Top 20 brands with highest combined streaming and linear spend (ranked from most to least in AVOD spend)

Source: Vivvix

Where's the white space?

Retail advertisers zeroed in on Hulu and Pluto TV, but they backed out on one platform that you may want to keep an eye on.

Their month-over-month spend on Disney+ decreased by almost 53% from $8.2M in October to $4.3M in November despite the heightened investment across all other platforms.

We saw a sizeable decrease of $40M for restaurants—about 29% less—and a $2.8M difference for food and beverage.

Games, toys and sporting goods fell to the 12th-ranked spot after securing 10th in October despite the nearness of the holidays—spend decreasing by 11.2%, or almost $5.5M. Advertisers in the industry spent less on the previously-favored Pluto TV—54.5% or $7.4M less.

Finally, our first-ever Crackle analysis shows curious irregularities across our top 10 industries. Second overall, food and beverage spent less than $300K there, for example, making them the seventh-highest spender on the platform, and personal care products weighed just under $17K.

Be sure to check back in next month for even more Crackle content.

CTV/STREAMING INTEL

Each month, we’ll share the latest insights including spend, trends, and creative in one of the most competitive landscapes to date. Stay tuned as we #FreeTheData.

Want access to streaming data and breaking creatives? Contact us here.